88 dated – Notify the taxpayers having AATO> Rs 100 Crores to issue e-invoices from January 2021. 05 dated – Notify the taxpayers having AATO> Rs 50 Crores to issue e-invoices from April 2021. 23 dated – To include certain classes of registered persons into the exemption list from issuing e-invoices. 01 dated – Notify the taxpayers having AATO> Rs 20 Crores to issue e-invoices from April 2022. 14 dated – Rule 46(s) requires mandatory declaration in the tax invoices. 17 dated – Notify the taxpayers having AATO> Rs 10 Crores to issue e-invoices from October 2022. 10 dated – Notify the taxpayers having AATO> Rs 5 Crores to issue e-invoices from August 2023.

#Wef net invoices online code

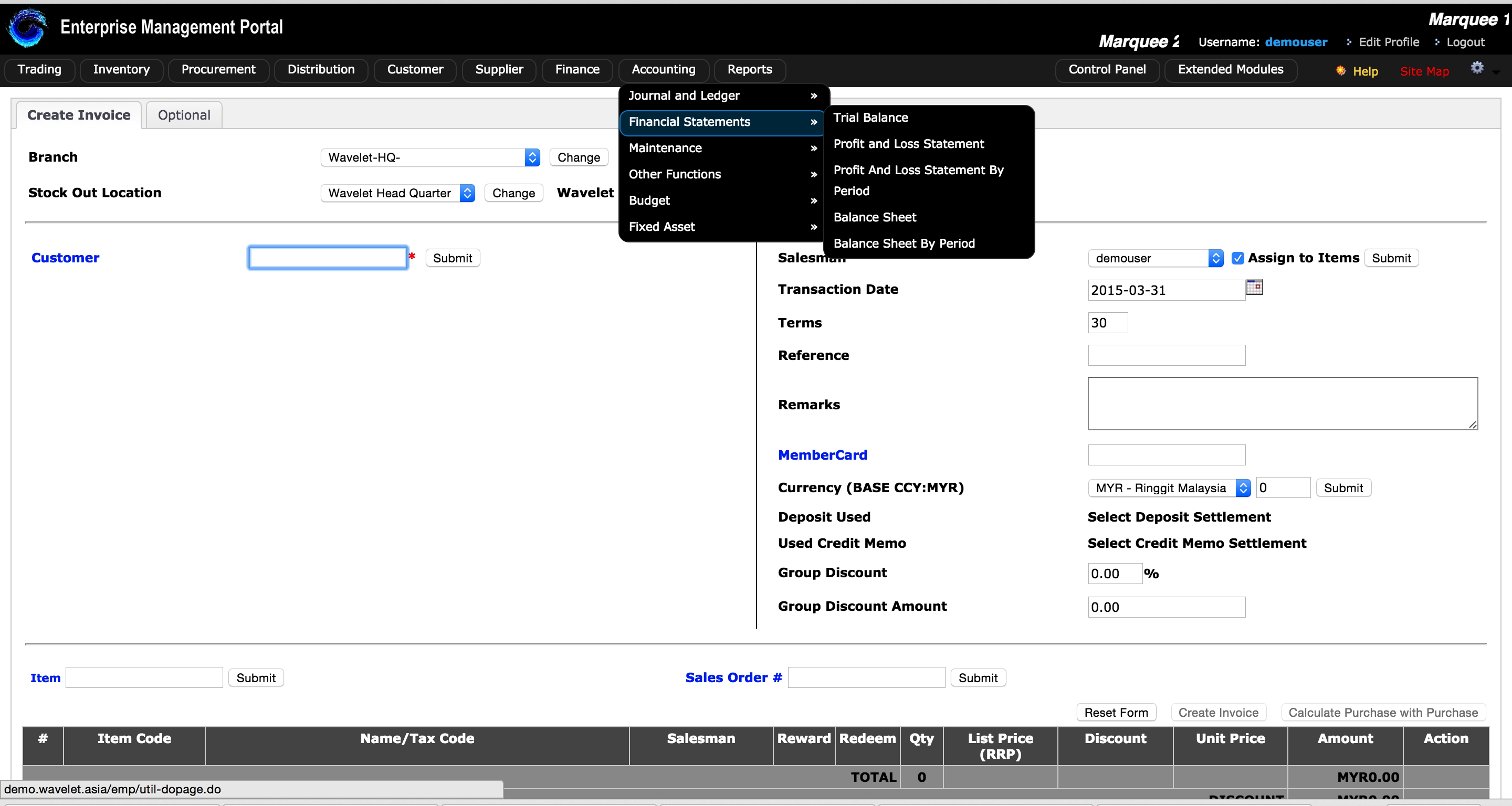

You can enter a GSTIN and enter the captcha code and check whether a particular GSTIN is supposed to issue an e-invoice or not.ĬBIC has issued the following notifications so far laying down the legal roadmap for E-Invoicing

#Wef net invoices online how to

How to check whether a particular GSTIN is supposed to issue an e-invoice? Specimen for such declaration to be obtained from vendors. 1st August 2023.Į-invoicing is being implemented in a phased manner so it is advisable (not mandatory) to obtain a declaration from vendors about whether e-invoicing is applicable to them or not. Phase VI – E-invoicing will be mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs.

Phase V – E-invoicing will be mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs. Phase IV – E-invoicing will be mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs. Phase III – E-invoicing was made mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs. Phase II – E-invoicing was made mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs.

Phase I – E-invoicing was made mandatory for registered taxpayers, other than a special economic zone unit & those referred to in sub-rule (2), (3), (4) & (4A) of rule 54, whose aggregate turnover in any preceding financial year exceeds Rs. GST Council had first approved the standard of e-invoice in the 37 th GST Council Meeting held on 20th Sep 2019.

Note: C BIC has notfied 1st August 2023 as the date from which e-invoicing will be made mandatory for the taxpayers whose AATO is above Rs 5 crores vide a CGST Notification no. On 28th July 2022 – Testing was enabled for the taxpayers having AATO between Rs 5 Crores to Rs 10 Croreson e-invoicing API sandbox. E-invoicing is being implemented phase-wise in the country as and when the functionality and technology to implement the same is ready with the Government. The government is looking at addressing the above issues from the point of inception of any transaction i.e. Government is in no mood to leave any scope to fix the loopholes for tax leakages and tax evasion fake invoicing, circular trading, etc. Last updated on May 11th, 2023 at 07:25 pm

0 kommentar(er)

0 kommentar(er)